The IT sector has enjoyed huge growth over the past decades, however, the past year saw a dip in the industry with the looming possibility of recession across economies. This year started with the news of many layoffs across industries and the tech sector was among the worst hit. The sector is one of the top sectors in the country in terms of employers and revenue generators for the economy. Here are the details of the IT sector of the country and top stocks in terms of market capitalisation. Read More: FMCG Sector in Focus-Stocks to watch out for

The IT sector has enjoyed huge growth over the past decades, however, the past year saw a dip in the industry with the looming possibility of recession across economies. This year started with the news of many layoffs across industries and the tech sector was among the worst hit. The sector is one of the top sectors in the country in terms of employers and revenue generators for the economy. Here are the details of the IT sector of the country and top stocks in terms of market capitalisation. Read More: FMCG Sector in Focus-Stocks to watch out for

The IT sector accounted for approximately 7.4% of the country’s GDP in FY 22 and is expected to contribute approximately 10% of the country’s GDP by 2025. India has one of the largest internet user bases of approximately 76 crore users at the same time providing internet at one of the cheapest rates across the world. This number is set to increase in the coming years with the government’s push for the digital economy. The Indian IT industry has achieved significant growth, with revenues reaching US$227 billion in FY22, representing a YoY growth of 15.5%, as reported by the National Association of Software and Service Companies (Nasscom). By 2025, the Indian software product industry is projected to reach US$100 billion, with Indian companies focusing on international investments to enhance their global delivery centers and expand their global footprint. The data annotation market in India is expected to grow exponentially, reaching US$7 billion by 2030, driven by domestic demand for AI, with the US market contributing 60% to the overall value. In FY22, the IT industry added 4.45 lakh new employees, bringing the total employment in the sector to over 50 lakh employees. However, due to the ongoing concerns of recession and the global factors the growth rate in FY 23 is estimated to be approximately 8.4% taking the sector to hit US$245 billion in size.

The digital infrastructure of the country is seeing a tremendous increase to support and boost the growing demand in the country for technology and the increase of AI in different fields. The government along with the private sector is continuously investing in the IT sector and emerging technologies. The domestic revenues from the sector are growing 13% from FY 22 in INR terms and there is a huge increase in digital spending among the masses of the country. India has become a global leader in deeptech innovation capabilities and research and development (R&D) in recent years. The country is committed to driving future growth and innovation for global enterprises. One of the key factors contributing to this success is the presence of global capability centers (GCCs) in India. Currently, around 40% of global GCCs are located in the country, which highlights the significant opportunity for India to scale up its capabilities further. In the past year, India has added 65 new GCCs, bringing the total number to over 1,570. This demonstrates the country's potential to attract more GCCs and further cement its position as a destination of choice for engineering R&D. Through continuous efforts of the government to provide a level playing field for the Indian exporters, the service export revenue from this sector is expected to reach US$ 194 billion in the current year registering a growth of approximately 9.4% from the previous year. The government has also encouraged FDI (Foreign Direct Investment) by permitting 100% FDI in this sector. Furthermore, the government also promotes R&D in this sector through various tax incentives like the deduction of up to 150% of the expenditure incurred on in-house R&D available under the Income Tax Act and a reduction in the overall taxation level in the electronic hardware. there are many existing government schemes that aid entrepreneurs in this sector along with new schemes like the Support International Patent Protection in Electronics & IT (SIP-EIT) and Multiplier Grants Scheme (MGS).

The digital infrastructure of the country is seeing a tremendous increase to support and boost the growing demand in the country for technology and the increase of AI in different fields. The government along with the private sector is continuously investing in the IT sector and emerging technologies. The domestic revenues from the sector are growing 13% from FY 22 in INR terms and there is a huge increase in digital spending among the masses of the country. India has become a global leader in deeptech innovation capabilities and research and development (R&D) in recent years. The country is committed to driving future growth and innovation for global enterprises. One of the key factors contributing to this success is the presence of global capability centers (GCCs) in India. Currently, around 40% of global GCCs are located in the country, which highlights the significant opportunity for India to scale up its capabilities further. In the past year, India has added 65 new GCCs, bringing the total number to over 1,570. This demonstrates the country's potential to attract more GCCs and further cement its position as a destination of choice for engineering R&D. Through continuous efforts of the government to provide a level playing field for the Indian exporters, the service export revenue from this sector is expected to reach US$ 194 billion in the current year registering a growth of approximately 9.4% from the previous year. The government has also encouraged FDI (Foreign Direct Investment) by permitting 100% FDI in this sector. Furthermore, the government also promotes R&D in this sector through various tax incentives like the deduction of up to 150% of the expenditure incurred on in-house R&D available under the Income Tax Act and a reduction in the overall taxation level in the electronic hardware. there are many existing government schemes that aid entrepreneurs in this sector along with new schemes like the Support International Patent Protection in Electronics & IT (SIP-EIT) and Multiplier Grants Scheme (MGS).

The IT sector in India is one of the strongest pillars of the economy and has given a significant contribution to pushing it to become the 5th largest economy in the world. According to a survey by Amazon Web Services conducted in 2021, India is expected to have nine times more digitally skilled workers by 2025. IT spending in India is also expected to increase to US$110.3 billion in 2023 from an estimated US$81.89 billion in 2021. In November 2021, Mr. Piyush Goyal, Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles, commended the Indian IT sector for its competitive strength and acknowledged the potential of service exports from India to reach US$1 trillion by 2030, without any government interference.

The IT sector in India is one of the strongest pillars of the economy and has given a significant contribution to pushing it to become the 5th largest economy in the world. According to a survey by Amazon Web Services conducted in 2021, India is expected to have nine times more digitally skilled workers by 2025. IT spending in India is also expected to increase to US$110.3 billion in 2023 from an estimated US$81.89 billion in 2021. In November 2021, Mr. Piyush Goyal, Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles, commended the Indian IT sector for its competitive strength and acknowledged the potential of service exports from India to reach US$1 trillion by 2030, without any government interference.

Some of the top stocks in this industry in terms of market capitalisation and their details are mentioned hereunder.

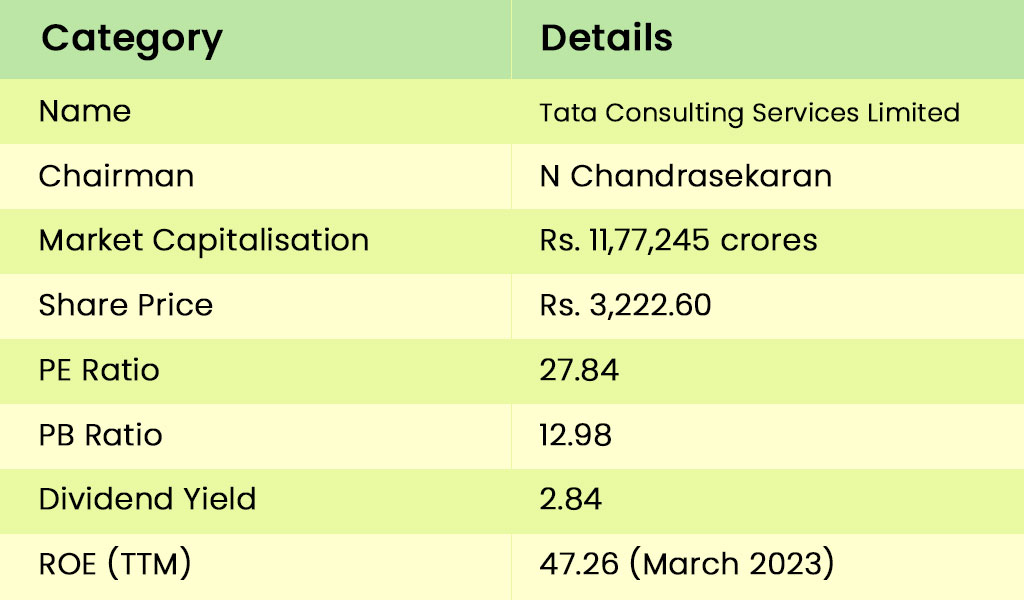

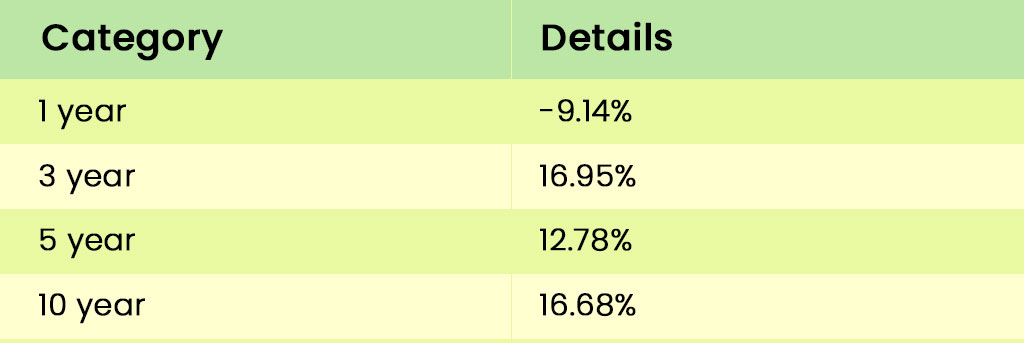

This is the flagship company and the crown jewel in the Tata Group. TCS is in the business of providing IT services, consulting, and business solutions. The company has partnered with many large businesses across the globe and offers a consulting-led, cognitive-powered, integrated portfolio of business, technology, and engineering services and solutions. The key details of the company are tabled below.  The trailing returns for TCS are tabled below.

The trailing returns for TCS are tabled below.

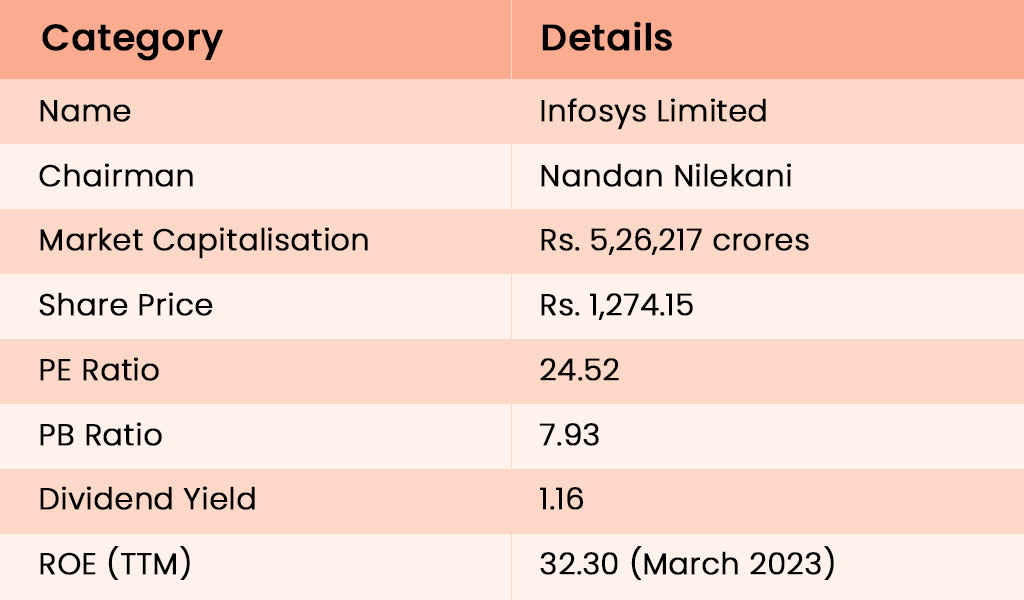

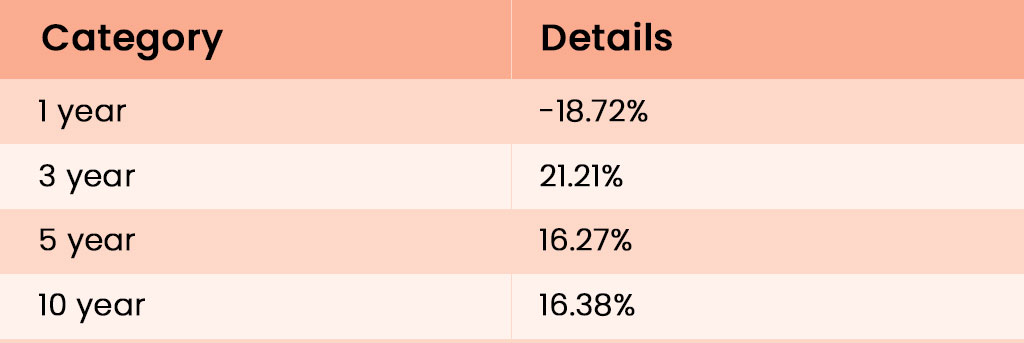

Infosys is often considered as the pioneer name in the IT sector and is in the business of providing consulting, technology, outsourcing, and next-generation digital services to enable clients to execute strategies for their digital transformation. The key details of the company are tabled below.  The trailing returns for Infosys are tabled below.

The trailing returns for Infosys are tabled below.

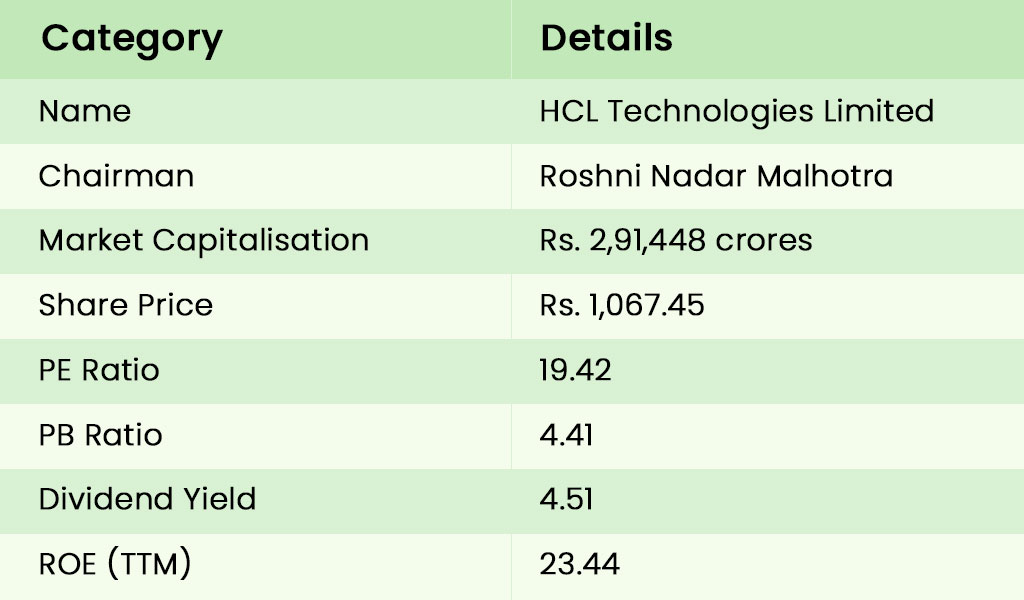

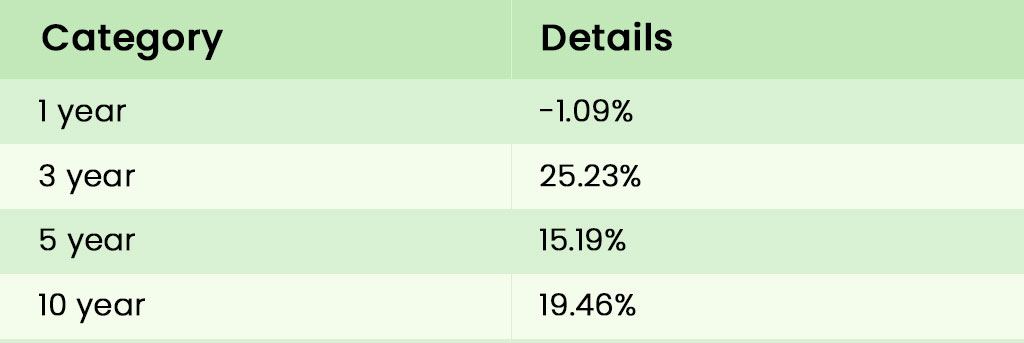

HCL Technologies was incorporated in 1999 and is consistently ranked among the top 5 companies in the country. The company has a network in 46 countries and focuses on transformational outsourcing and offers an integrated portfolio of services including software-led IT solutions, remote infrastructure management, engineering and R&D services, and BPO. The key details of the company are tabled below.  The trailing returns for HCL Technologies are tabled below.

The trailing returns for HCL Technologies are tabled below.

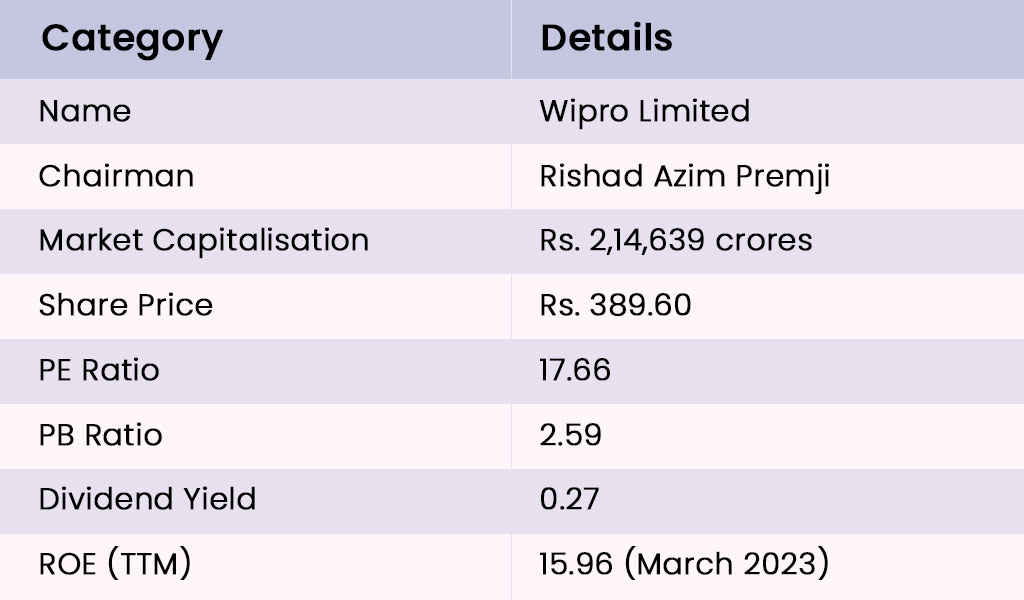

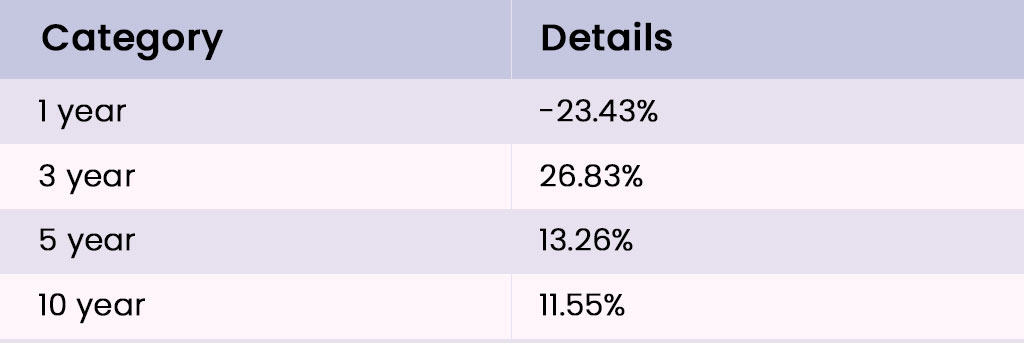

This is the fourth largest company in the Indian IT sector and is engaged in Information technology, consulting, and business process services (BPS). The key details of the company are tabled below.  The trailing returns for Wipro Limited are tabled below.

The trailing returns for Wipro Limited are tabled below.

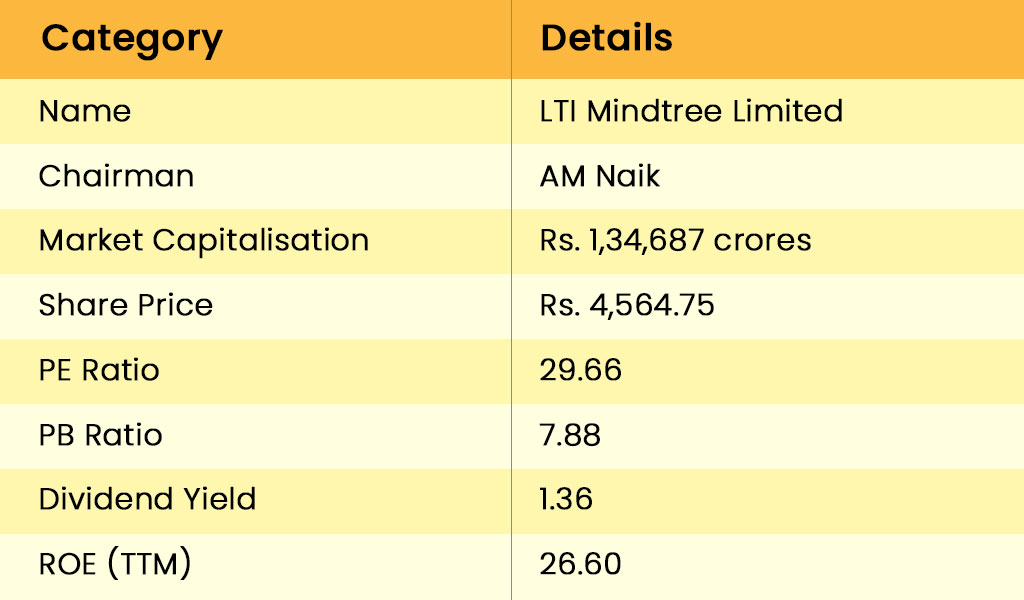

L&T is one of the largest names in India and abroad and is engaged in the business of providing an extensive range of IT services like application development, maintenance and outsourcing, enterprise solutions, infrastructure management services, testing, digital solutions, and platform-based solutions to the clients in diverse industries. The key details of the company are tabled below. The trailing returns for LTI Mindtree Limited are tabled below.

L&T is one of the largest names in India and abroad and is engaged in the business of providing an extensive range of IT services like application development, maintenance and outsourcing, enterprise solutions, infrastructure management services, testing, digital solutions, and platform-based solutions to the clients in diverse industries. The key details of the company are tabled below. The trailing returns for LTI Mindtree Limited are tabled below.

The Indian IT sector has the largest market share in the global services sourcing industry and is the market leader in digital skills readiness. Furthermore, India ranks as 3rd largest and among the fastest-growing hubs for technology startups. The Indian IT sector saw over 2,80,000 employees reskilled and made digitally skilled in FY 22 and is also seeing an uptick in the export share and share in the GDP. The growth drivers in this sector include the latest technologies like the blockchain, remote working, National Optic Fibre Network (NOFN), Digital India Programme, and the tech start-up revolution backed by growing demand for Artificial Intelligence. We hope this article was good enough to provide information about the tech sector in the country and its top stocks in terms of market capitalisation. Let us know if you are seeking more information about this sector or any of its components or have any queries regarding the same. Till then Happy Reading!

We often hear Mr. Nitin Gadkariu saying that India will be a hub for electric v...

The recent Union Budget 2023 had a special focus on renewable energy and the go...

Unless you are living under a rock, you cannot miss the increasing use of AI in...