Just like many types of securities, stock markets also offer a diverse form of trading depending on individual preferences like risk-return perception, duration of trading, and more. In our earlier blogs, we discussed the details of different types of trading styles like intraday trading, swing trading, etc. Continuing with this series, let us discuss another trading style that is quite popular, which is scalping. Read on to know the meaning of scalping and all the related details of the same. Read More: Top stock market crashes in India

Just like many types of securities, stock markets also offer a diverse form of trading depending on individual preferences like risk-return perception, duration of trading, and more. In our earlier blogs, we discussed the details of different types of trading styles like intraday trading, swing trading, etc. Continuing with this series, let us discuss another trading style that is quite popular, which is scalping. Read on to know the meaning of scalping and all the related details of the same. Read More: Top stock market crashes in India

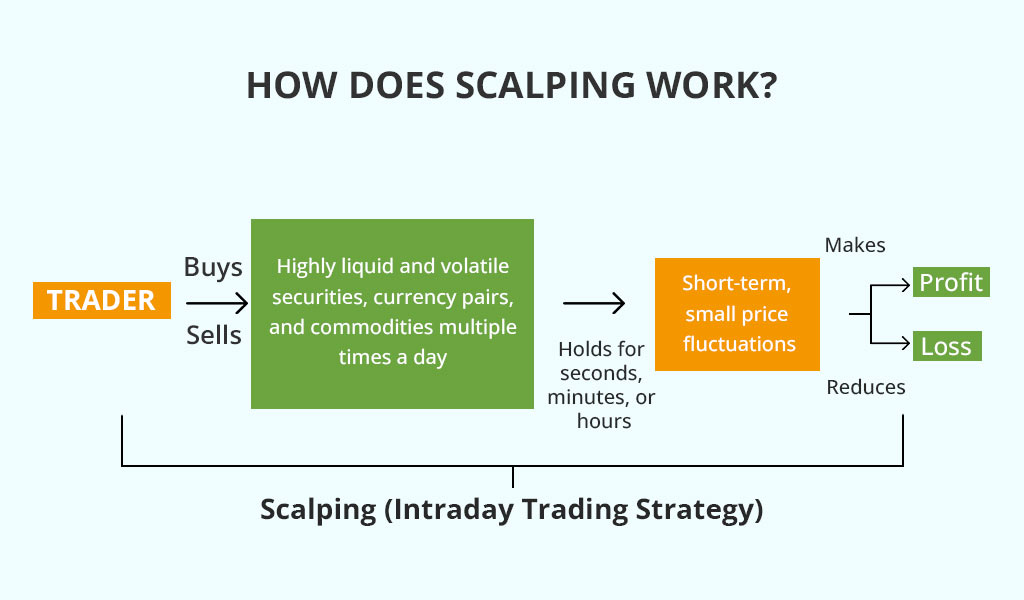

Scalping trading is a short-term trading strategy in the financial markets where traders aim to profit from small price movements in a security over a very short period of time. These trades can last from a few seconds to minutes and are typically executed multiple times throughout a trading session. Scalpers primarily focus on liquid assets with high trading volumes, such as stocks, currencies (forex), or cryptocurrencies. Scalping involves making a large number of trades during the day, capitalising on even the smallest price differentials. While the profit made per trade might be relatively small, the cumulative gains can be significant due to the high trading frequency. Scalping requires precision, quick decision-making, and a disciplined approach to managing risks.

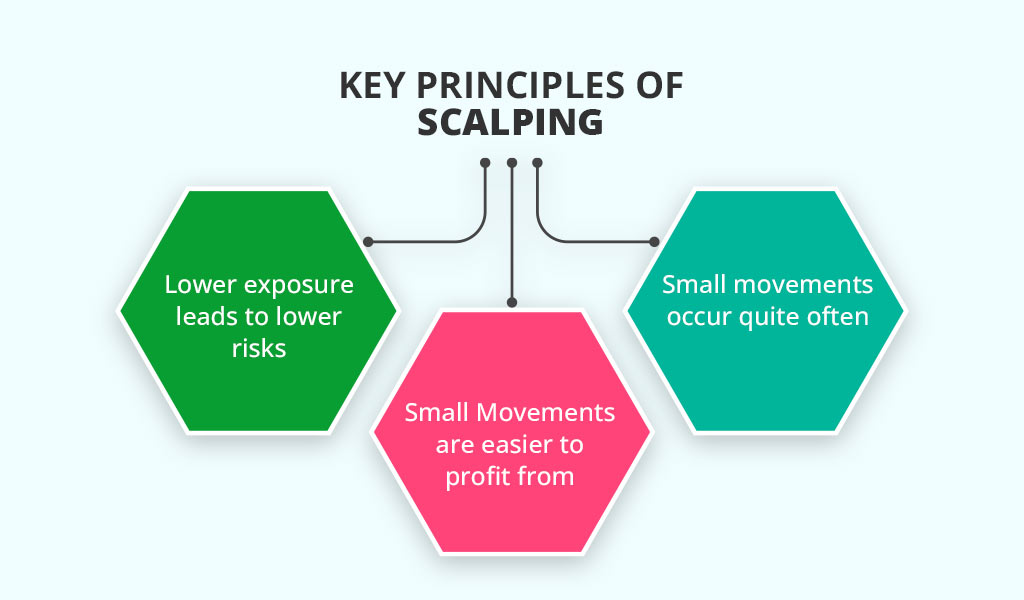

The core basis of scalping trading is to make quick profits in a span of a few seconds to minutes and to bank on the volume and frequency to make substantial profits. This is in stark contrast to long-term trading where positions are kept open overnight or even for weeks or months. With this premise, the key principles adhered to by scalpers that form the essence of scalping trading are explained below.

The core basis of scalping trading is to make quick profits in a span of a few seconds to minutes and to bank on the volume and frequency to make substantial profits. This is in stark contrast to long-term trading where positions are kept open overnight or even for weeks or months. With this premise, the key principles adhered to by scalpers that form the essence of scalping trading are explained below.

Scalpers believe that minimising the time spent in the market reduces their exposure to potential adverse market conditions. Since they hold positions for short durations, they are less susceptible to unexpected events or significant market shifts that can occur over longer periods.

Scalpers recognize that achieving substantial profits through significant price movements requires the stock's value to undergo considerable changes, which may be less frequent and harder to predict. In contrast, by targeting smaller price changes, scalpers can execute trades more frequently and capitalise on these more common, smaller market fluctuations.

Scalpers closely monitor the market and realise that even during relatively stable market conditions, there are frequent minor price adjustments in an asset's value. These small changes may be caused by various factors and are more readily exploitable by scalpers who are adept at identifying short-term trends and patterns.

Scalping is a game of quick decision-making and ensuring that these trades yield profits no matter the margin. The steps in a typical scalping trade can be explained as under.

Scalping is a game of quick decision-making and ensuring that these trades yield profits no matter the margin. The steps in a typical scalping trade can be explained as under.

While this strategy sounds simple, the key parameters required to successfully execute the same are proper risk management, the discipline to stick to the trading plan, and the ability to keep emotions in check.

Some of the popular scalping trading strategies are discussed hereunder.

Breakout scalping is all about spotting key support and resistance levels on the price charts. Support indicates the level when the asset stops falling and tends to bounce back while resistance signals the level when the asset stops rising and tends to contract. When the price moves beyond either level, it indicates the opportunity for scalpers to jump in and take advantage of the price fluctuations.

Breakout scalping is all about spotting key support and resistance levels on the price charts. Support indicates the level when the asset stops falling and tends to bounce back while resistance signals the level when the asset stops rising and tends to contract. When the price moves beyond either level, it indicates the opportunity for scalpers to jump in and take advantage of the price fluctuations.

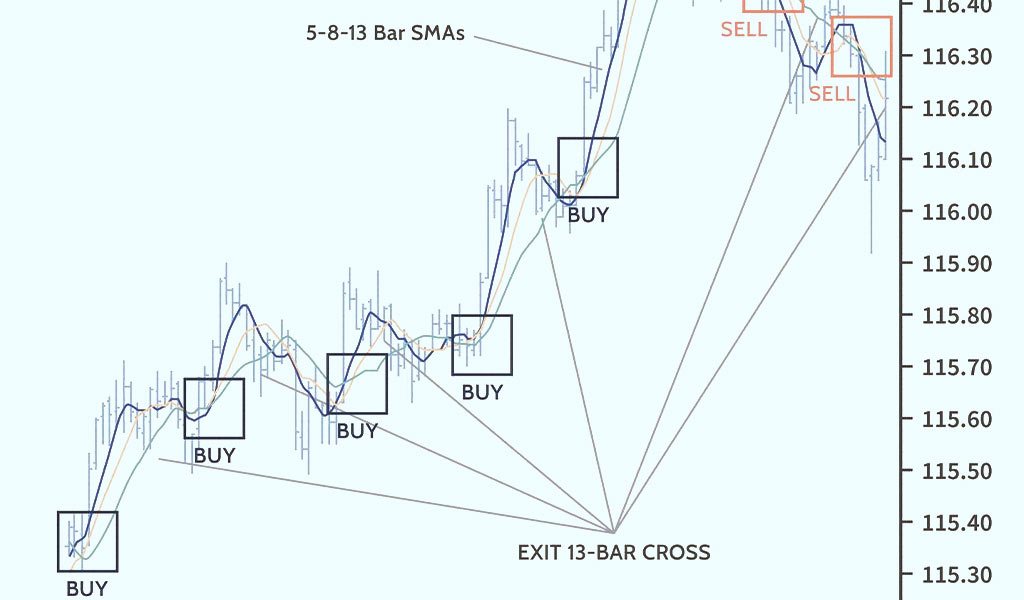

Moving averages are the lines on the price charts that smooth out the price fluctuations over the specified period of consideration. Scalpers generally use shorter moving averages like a 10-day period or a 20-day period to monitor short-term action. When the asset or the security crosses above the moving average mark it indicates a trading opportunity in the form of an uptrend while when it crosses below the moving average, it indicates a potential downtrend. Traders, therefore, focus on the moving average to determine potential entry and exit points while setting stop loss to safeguard from the downside of trading.

Moving averages are the lines on the price charts that smooth out the price fluctuations over the specified period of consideration. Scalpers generally use shorter moving averages like a 10-day period or a 20-day period to monitor short-term action. When the asset or the security crosses above the moving average mark it indicates a trading opportunity in the form of an uptrend while when it crosses below the moving average, it indicates a potential downtrend. Traders, therefore, focus on the moving average to determine potential entry and exit points while setting stop loss to safeguard from the downside of trading.

Bollinger Bands comprise three bands where the middle band is the moving average (usually of a 20-day period) while the outer bands are the standard deviation from the middle line. These outer lines contract and expand based on market volatility which is used to identify the overbought or the oversold position of the asset and take suitable trading decisions.

Bollinger Bands comprise three bands where the middle band is the moving average (usually of a 20-day period) while the outer bands are the standard deviation from the middle line. These outer lines contract and expand based on market volatility which is used to identify the overbought or the oversold position of the asset and take suitable trading decisions.

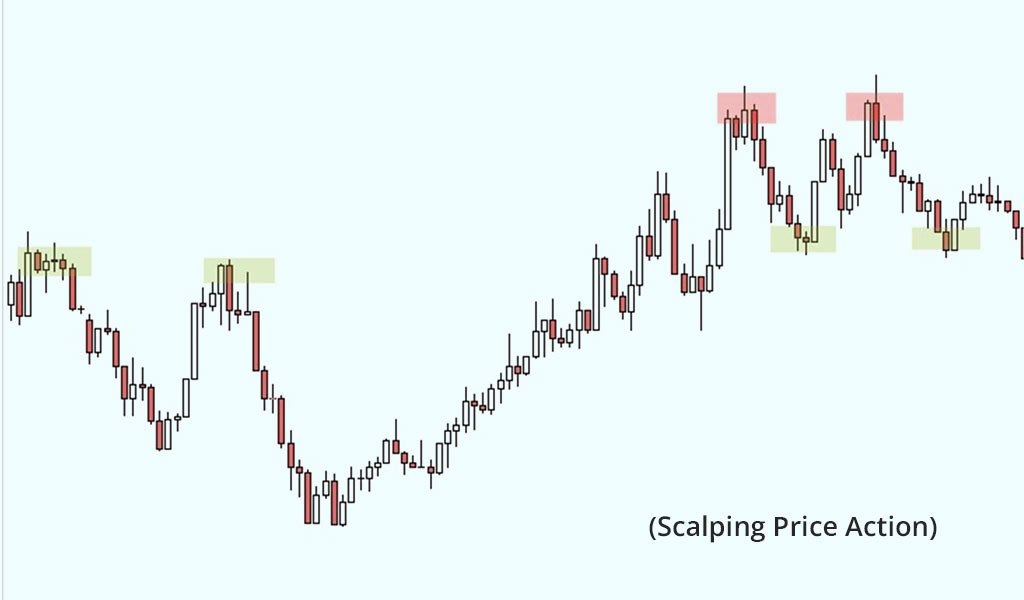

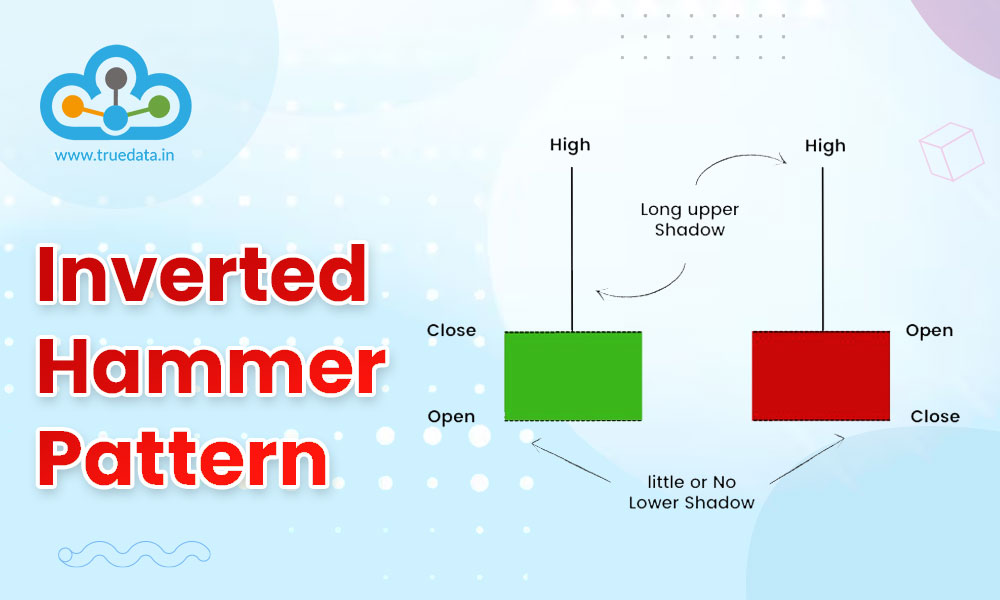

Price action is understanding the naked price movements without the filter of any indicators and focusing simply on the price charts. Traders usually take the help of various candlestick patterns like the doji candlestick pattern, hammer candlestick pattern, engulfing candles,m, etc. to identify potential price reversals or continuation of the price trends. These indicators are then used to understand the entry and exit points for the trade and take profits along the way.

Price action is understanding the naked price movements without the filter of any indicators and focusing simply on the price charts. Traders usually take the help of various candlestick patterns like the doji candlestick pattern, hammer candlestick pattern, engulfing candles,m, etc. to identify potential price reversals or continuation of the price trends. These indicators are then used to understand the entry and exit points for the trade and take profits along the way.

This is one of the most common trading strategies for scalpers. Stock markets are very sensitive to any news at the micro or macro level of the economy. It can be in the form of a quarterly report of the financial performance of the company or news like auditors or key personnel resigning, changes in the policies affecting the industry as a whole, or the GDP news of the country. These pieces of information create the premise for price fluctuations and scalpers take advantage of the same to make small profits.

This is one of the most common trading strategies for scalpers. Stock markets are very sensitive to any news at the micro or macro level of the economy. It can be in the form of a quarterly report of the financial performance of the company or news like auditors or key personnel resigning, changes in the policies affecting the industry as a whole, or the GDP news of the country. These pieces of information create the premise for price fluctuations and scalpers take advantage of the same to make small profits.

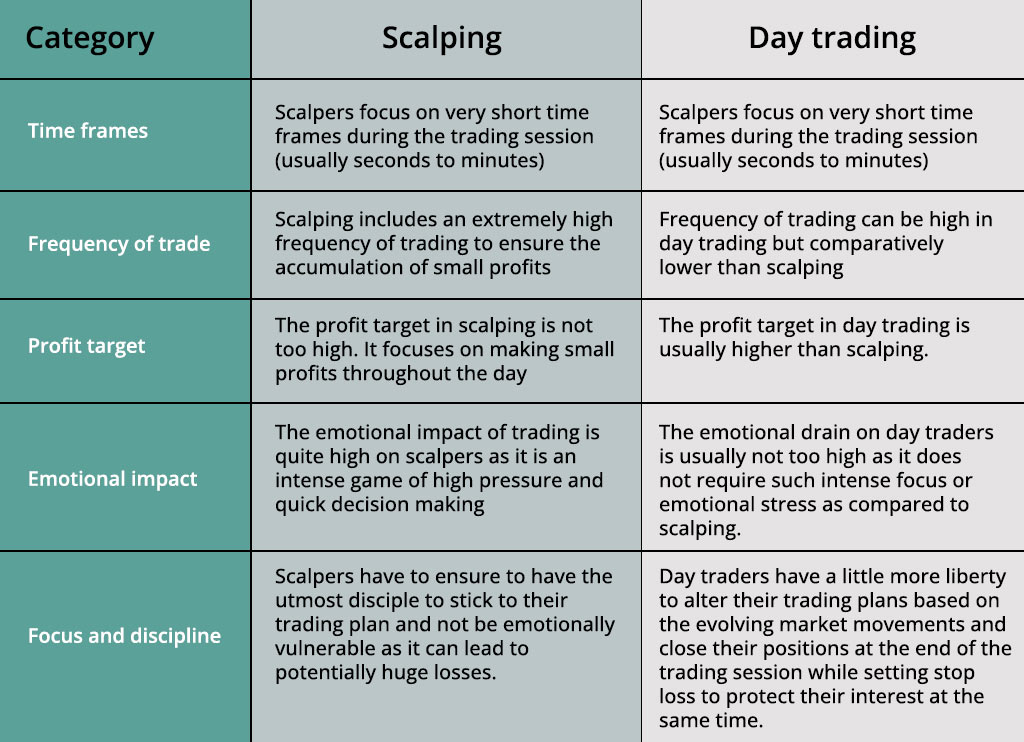

The key differences between scalping and day trading are highlighted hereunder.

Now that we have seen the key details of scalping, let us now come to the final part, the pros and cons of using scalping trading. Given here are the details of the same.

Now that we have seen the key details of scalping, let us now come to the final part, the pros and cons of using scalping trading. Given here are the details of the same.

Scalping's main advantage is that it allows traders to make small profits frequently. While each trade's profit might be small, these gains can accumulate over time, leading to a profitable overall strategy.

Scalpers avoid holding positions overnight, reducing the risk of being exposed to unexpected events or gaps that can occur between market sessions. This short-term approach provides more control over their trades.

Scalping doesn't tie up traders for extended periods like longer-term strategies. They can execute multiple trades during a single trading session and still have time for other activities.

Scalpers use tight stop-loss orders, which means they set a specific price level at which they will exit the trade to limit potential losses. This risk management technique helps preserve their capital and ensures that any losses are kept in check.

Scalping thrives in volatile markets where prices frequently experience rapid movements. Traders can capitalise on short-term price fluctuations created by market volatility.

Frequent trading can result in higher transaction costs, such as commissions and spreads. These costs can eat into profits, making it essential for scalpers to choose a broker with competitive fees as well as strive harder to increase the overall profits at the end of the day.

Scalping demands a trader's full attention during active trading hours. Traders must dedicate time and effort to spot opportunities and manage their positions effectively.

Scalping can be emotionally demanding due to its fast-paced nature. Traders need higher focus as well as the need to remain calm and composed to make quick decisions and avoid emotional reactions.

Scalping requires reliable and fast trading platforms and internet connections. Any delays or technical issues can adversely impact the ability to enter and exit trades swiftly.

Scalping is one of the popular trading strategies and is used not only in India but across the world. It is said time and again that this is a high-pressure high stakes game, therefore, it is important to understand the market and the nature of the securities as well as the target industry completely before taking a plunge into this type of trading. Hence, scalping is often not the best option for beginners as they lack the discipline to focus on small gains and understanding of the price and volume movements of the target security. We hope this article was able to provide an in-depth understanding of scalping and how it works. If you have any questions or need further details, do let us know and we will take it ahead. Till then Happy Reading!

The dollar exchange rate is constantly in the news and is often seen as a measu...

When we take our first step into the trading game, we choose the best resource...

Trend trading is one of the most popular forms of trading for a trader, especial...

Stock investing and trading are becoming primary and secondary sources of incom...