If you are a seasoned trader or a beginner in trading, one of the most pressing questions you face is when is the right time to enter or exit an investment? To have a clear understanding of the same it is important to understand the fundamental analysis and technical analysis concepts in detail. Dow Theory is an age-old principle yet a very strong pillar in understanding technical analysis. Check out this blog to learn all about the Dow Theory and how it is crucial for traders to have a successful trading portfolio.

Read More: Best financial books to read for beginners in stock market

Dow Theory, also called the Dow Jones Theory, is an old but important tool in finance. It was created by Charles H. Dow in the early 1900s. While Charles Dow did not compile his theories into a single book during his lifetime, his ideas were disseminated through his writings in The Wall Street Journal and other financial publications of his era. Even after Dow passed away in 1902, others like William Hamilton continued his work. They explained Dow's ideas in detail, and Robert Rhea published their work in 1932 in the book, ‘The Dow Theory’.

Dow Theory helps analysts understand how prices move and the patterns they form. Despite being more than a hundred years old, the concept of Dow Theory is still useful today. It helps investors make sense of the stock market and decide where to put their money efficiently. The lasting relevance of the book and the teachings of Charles Dow shows how valuable it is in understanding financial markets.

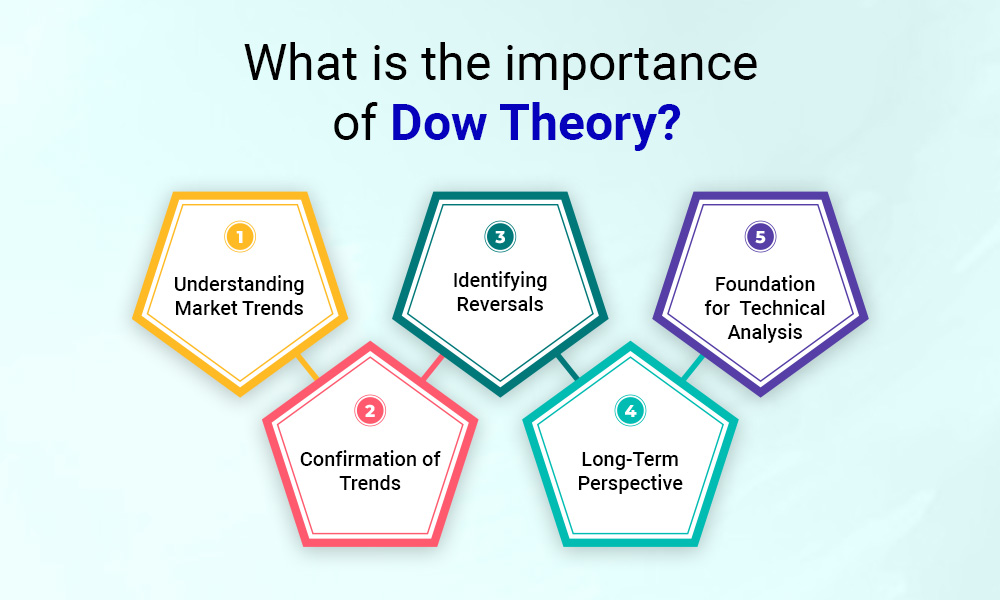

The importance of Dow theory can be explained hereunder,

Dow Theory provides traders with a valuable framework for understanding market trends. By analysing the movement of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA), traders can identify primary trends, secondary reactions, and minor trends in the market. This understanding helps traders anticipate potential shifts in market direction and adjust their trading strategies accordingly.

One of the key aspects of Dow Theory is the emphasis on confirming trends. According to the theory, significant market trends are confirmed when both the industrial and transportation averages move in the same direction. This confirmation provides traders with greater confidence in the sustainability and reliability of the identified trend, enabling them to make more informed trading decisions.

Dow Theory equips traders with tools to identify potential trend reversals in the market. By recognising the signs of primary trend reversals, such as divergences between price movements and trading volumes, traders can anticipate shifts in market sentiment and position themselves accordingly. This ability to identify reversals early can help traders mitigate risks and capitalise on emerging opportunities.

Another important aspect of Dow Theory is its focus on long-term market analysis. Rather than getting caught up in short-term fluctuations, Dow Theory encourages traders to adopt a broader perspective and consider the underlying trends shaping the market over extended periods. This long-term view helps traders avoid knee-jerk reactions to temporary market movements and stay focused on the bigger picture.

Dow Theory serves as a foundational framework for technical analysis, providing traders with a solid basis for evaluating market dynamics and making informed trading decisions. By understanding the principles of Dow Theory, traders can complement their technical analysis tools and strategies, enhancing their ability to navigate the complexities of the financial markets with confidence and proficiency.

The Dow Theory, also known as the Dow Jones Theory of Technical Analysis, is a fundamental framework that laid the groundwork for modern technical analysis. Developed by Charles Dow, the co-founder of Dow Jones & Company and editor of The Wall Street Journal in the late 19th century, the Dow Theory remains relevant and influential in the realm of financial markets and trading strategies.

The Dow Theory is based on specific tenets which are explained hereunder.

At the core of the Dow Theory is the belief that the market incorporates and reflects all available information, including fundamental factors, economic indicators, and psychological sentiments. This implies that the price of security encapsulates all known and relevant information at any given time. As such, participants in the market analyse price movements and trends to make informed decisions about buying and selling securities.

In practical terms, traders using the Dow Theory recognise that attempting to gain an edge by accessing exclusive information or predicting unforeseeable events is futile. Instead, they focus on interpreting price action and market trends to identify potential trading opportunities.

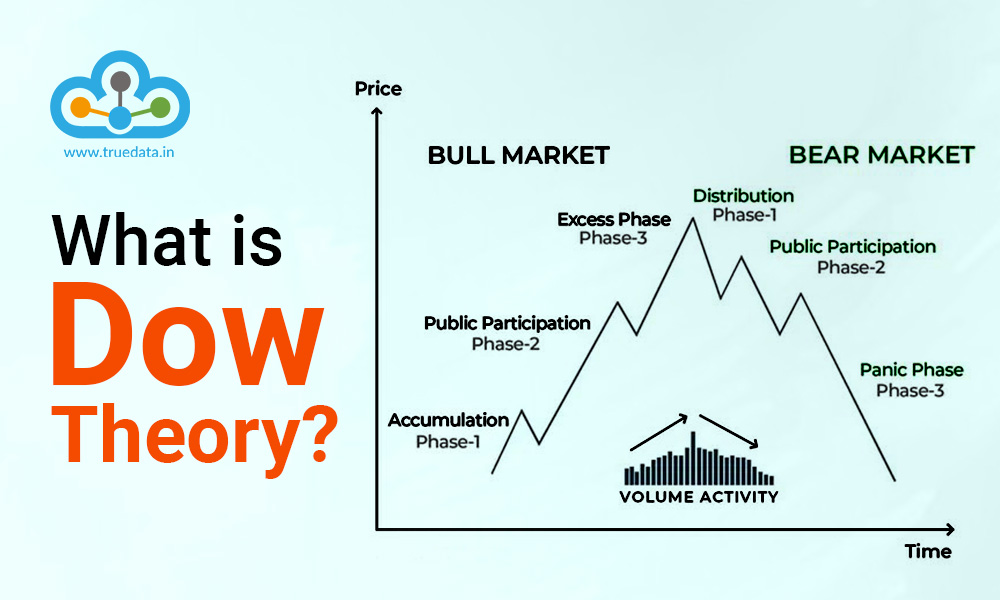

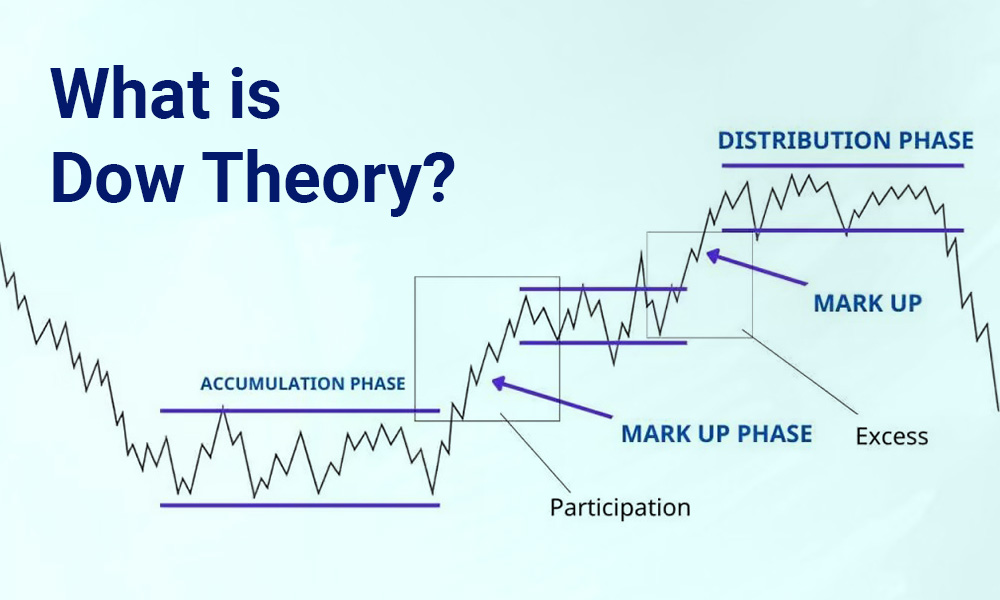

According to Dow Theory, price movements in the market unfold in discernible trends over time. These trends can be broadly categorised into three primary phases: the accumulation, the public participation, and the panic or speculation phase. Understanding and identifying these phases is essential for traders seeking to capitalise on price movements and make informed trading decisions while minimising exposure to countertrend fluctuations. Traders using Dow Theory techniques employ various technical analysis tools, including chart patterns, trendlines, and moving averages, to identify the direction and strength of phases.

Dow Theory distinguishes between three types of trends: the primary trend, the secondary trend, and minor fluctuations. The primary trend represents the overarching direction of the market, typically lasting for months or even years. It reflects the underlying economic fundamentals and prevailing investor sentiment.

Secondary trends, also known as corrections or retracements, occur within the primary trend and typically last for weeks to months. These movements represent temporary reversals or adjustments in response to short-term factors or market sentiment.

Minor fluctuations, on the other hand, are short-term price movements that occur within the context of the secondary trend. These fluctuations are often characterised by increased volatility and noise but are generally inconsequential to the broader trend analysis.

Dow Theory emphasises the importance of confirmatory signals to validate and strengthen the analysis of market trends. Confirmatory signals provide additional evidence or affirmation of the prevailing trend direction, increasing the confidence of traders in their trading decisions.

Traders utilising Dow Theory techniques employ a variety of technical indicators and chart patterns to identify confirmatory signals. These may include bullish or bearish price patterns, volume analysis, momentum oscillators, and trend-following indicators. By combining multiple signals and indicators, traders can enhance the robustness of their analysis and mitigate the risk of false signals or market noise

In Dow Theory, volume serves as a critical indicator that validates price movements and trends in the market. Volume represents the total number of shares or contracts traded within a specific period and provides insights into the level of participation and conviction among market participants.

In an uptrend, increasing volume during price advances confirms the strength and sustainability of the upward movement, suggesting broad-based buying interest and positive market sentiment. Conversely, declining volume during price declines in a downtrend signals potential weakness and lack of conviction among sellers, potentially indicating an impending reversal or consolidation phase.

By analysing volume patterns alongside price movements, traders can gain valuable insights into the underlying dynamics driving market trends and make more informed trading decisions.

The final tenet of Dow Theory asserts that trends persist until proven otherwise by definitive reversal signals. Once established, trends tend to exhibit resilience and momentum, continuing in their respective directions until fundamental factors or significant shifts in market sentiment catalyse a reversal.

Traders adhering to Dow Theory principles exercise patience and discipline, allowing trends to unfold and validate before considering contrarian positions or trend reversals. By aligning with the prevailing trend and respecting the principle of trend persistence, traders can position themselves strategically to capitalise on extended price movements and mitigate the risk of premature exits or reversals.

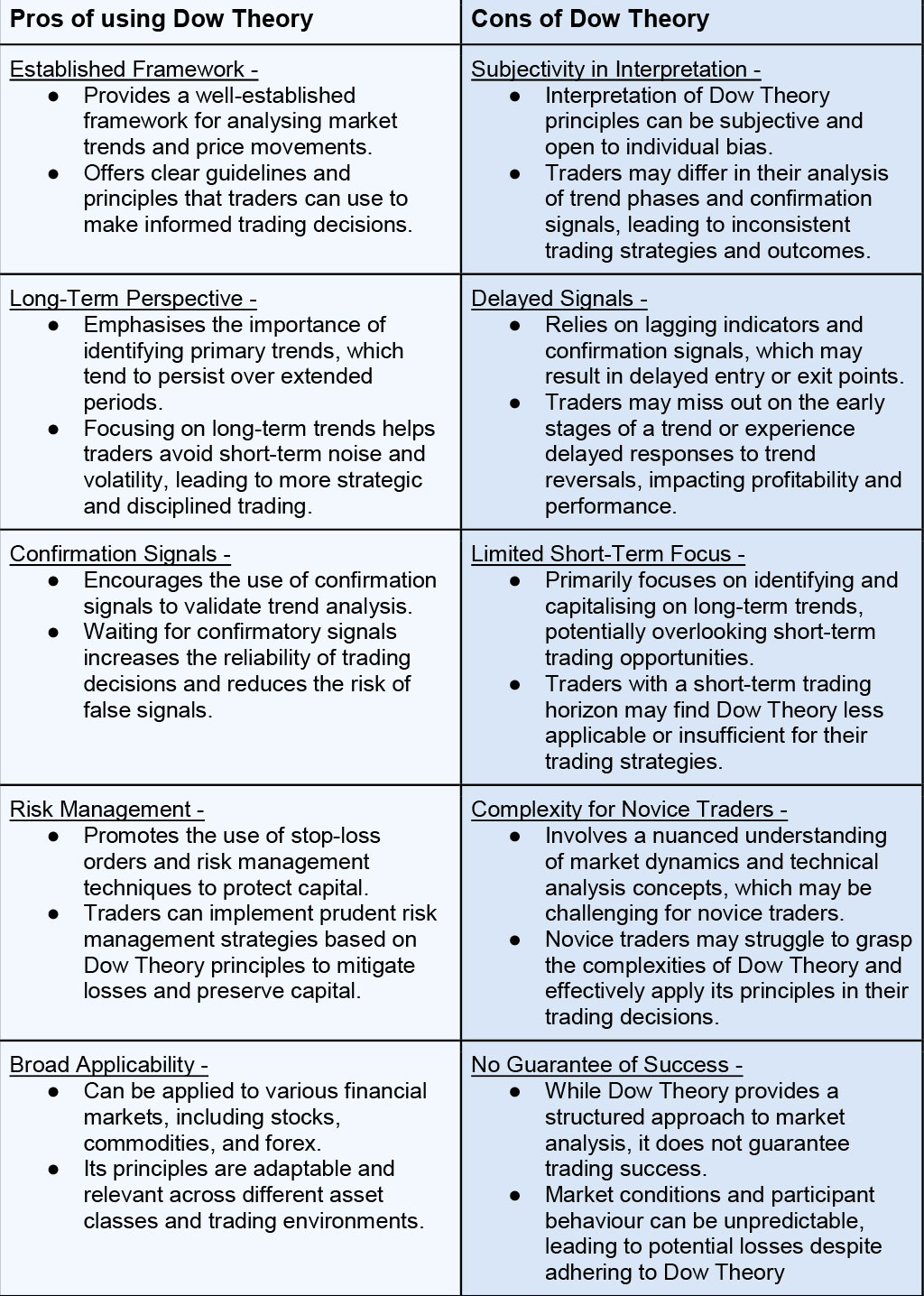

The pros and cons of using the Dow Theory can be tabled in the following manner.

For traders seeking to navigate the complexities of financial markets and enhance their trading strategies, the Dow Theory offers a comprehensive framework grounded in its principles. By understanding and applying the Dow Theory, traders can gain valuable insights into market behaviour, identify high-probability trading opportunities, and navigate market trends with greater confidence and precision.

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Buying shares from the stock market seems to be an easy task - as it can be done...

Market eye filters is made creatively to help you take advantage of market oppor...

There are very few things that investors agree on, and one of them is that earni...